Here’s something that many folks think they know the answer to. . . . Is a Hit and Run automatically an Uninsured Motorist claim or am I required to pay my Deductible?

The quick answer is, NO a Hit & Run is NOT an automatic get out of jail free incident and yes, your Collision Deductible Applies! – Your insurance company has to spend money first, in order to then do the research required to recoup their loss. Depending on the insurance company, this could be rather quick or take forever and a day.

The long answer is, that it depends on who insures you (this could get complicated so I hope you are sitting comfortably while reading this post).

– Did you choose your insurance based on the quality and broad language of your insurance policy? Do you even know what that means? Or did you choose it based on brand recognition? Because you like the commercial you see! Or was it solely based on pricing? – All of this matters in insurance and it is our duty as insurance professionals to help you, the client/the consumer, to see and understand what you gain or lose by the choice you make. – Which is also why we have options for you and we represent multiple companies as both brokers and agents.

At my agency we are always talking about the A, B, C’s of insurance. It is how we present a proposal to our clients. It is the most important step in the entire process because our advice will help our client determine which option to choose. It is the “nuts and bolts” of the policy that will play out during the most difficult time for many, during a claim.

I’ll tell you a story about one of our clients and it’s a story that repeats itself with so many of our clients and maybe even you. . . . .

Recently the spouse of a long time client called in asking me to “shop” their Auto Insurance. They are with one of our A type carriers and I did what I normally do. I dug into the WHY of this request. Her answer was that of many before, “I am paying too much for this insurance and my friends pay less for (insert advertisement heavy company here)”. I reviewed their policy there and then, and I noticed her claims & violation history was a factor in her pricing issue. However, her policy is designed in such a way that the only option in reducing price was to take away what she had become accustomed to. – Fast forward a month later and I meet with the husband. He tells me that he does not want to move companies. He has experienced good claims handling but due to her request he will remove coverage on his Mustang. I advised him as to how each line of coverage works. He decides to simply remove the Collision coverage which was the highest priced line on that car’s coverage. – – – Guess what happened two weeks later?? – – – A neighbor’s guest backed up into his parked Mustang and took off!! Neighbors go missing and the mystery hit & run car is nowhere to be found

. Fortunately, another neighbor took down the license plate number and it was reported to the local Police Department

. Do you think that the PD did anything? Nope! No one was hurt, a peace officer did not witness the collision and so there is nothing that will be done. The local PD has more important things to do. The PD simply took the report and advised our clients to make an insurance claim. – – Our clients were devastated because they no longer had Collision coverage and they assumed that nothing could be done

. However, they still had a great quality insurance company and I advised them to claim the hit and run incident. The insurance carrier did their research

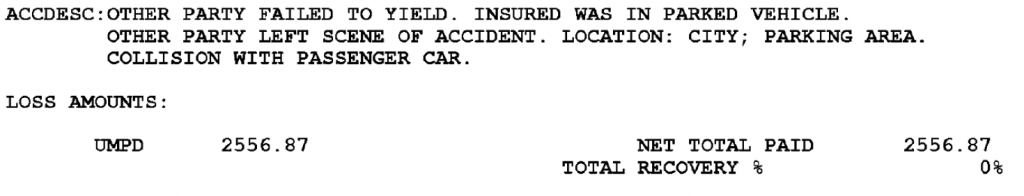

and based on the policy language it was decided that it would be best handled as an Uninsured Motorist Property Claim. Paying out our clients a check for $2,556.87 without requiring any deductible!!

The morale of this story is that not all insurance is created equal. What do I mean? The best way for me to describe what I mean is by comparing insurance policies to shoes. – Policies are like shoes, each is meant to to be used for a purpose. A running shoe is not meant to replace work boots and a pair of bargain dress shoes is not meant to out perform a quality built pair of leather shoes. – When shopping for your policy, be clear as to what you expect at the time of a claim, listen to the advice given by the licensed insurance professional and then choose your policy with care. Because your choice will pay dividends or bankrupt you when you most need from your insurance.

post written by: Domingo Ramos, Insurance Broker, proudly licensed to transact insurance in California, Oregon, Washington, Nevada, Texas and Michigan. – domingo@tcsib.com